capital gains tax canada 2020

For best results download and open this form in Adobe ReaderSee General information for details. You may be able to claim the capital gains.

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

Canada Capital Gains Tax 2022 with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world.

. The inclusion rate has varied over time see graph below. The proceeds of disposition. The inclusion rate is the percentage of your gains that are subject to tax.

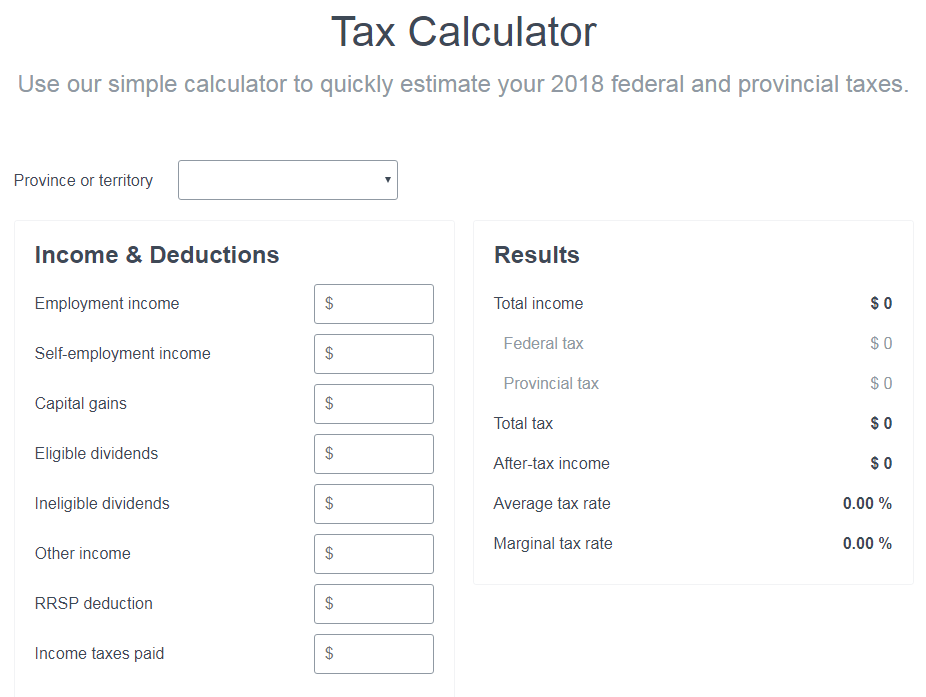

For people with visual impairments the following alternate formats are also available. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. To calculate your capital gain or loss you need to know the following 3 amounts.

As of 2022 it stands at 50. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the.

5000-S3 Schedule 3 - Capital. An eligible individual is entitled to a cumulative lifetime capital gains exemption LCGE on net gains realized on the disposition of qualified propertyThis exemption also. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high.

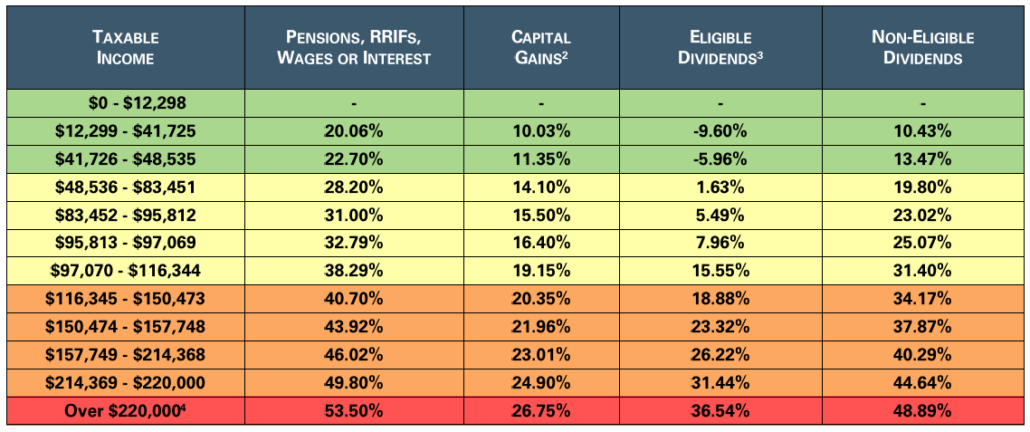

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. Dividends distributed within taxable periods commencing after. Whats new for 2020.

Since its more than your ACB you have a capital gain. Lifetime capital gains exemption limit For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit. Should you sell the investments at a.

The adjusted cost base ACB the outlays and expenses incurred to sell your. Your sale price 3950- your ACB 13002650. What is the capital gains tax rate for 2020 in Canada.

Capital Gains Tax Rate In Canada 50 of the value of any capital gains are taxable. New Hampshire doesnt tax income but does tax dividends and interest. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

The sale price minus your ACB is the capital gain that youll need to pay tax on. So for example if you. Schedule 3 is used by individuals to calculate capital gains or losses.

The Government continued to play softball with the 2020 Fall Economic Statement delivered by Finance Minister Freeland and did not proceed with the measures expected by.

Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

How Are Capital Gains Taxed Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax In Canada Explained

5 Categories Of Tax Planning Alitis Investment Counsel

3 Tips To Pay 0 Capital Gain Tax On Stocks With 100k Portfolio In Canada Eric Seto

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Investing Series How Does The Capital Gains Tax Work In Canada Save Spend Splurge

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

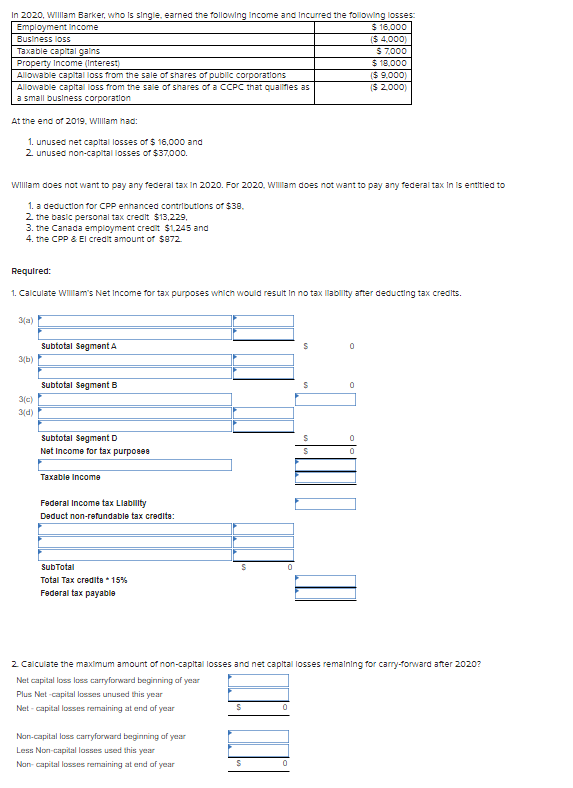

In 2020 Willam Barker Who Is Single Earned The Chegg Com

Tax Burden On Capital Income International Comparison Tax Foundation

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

Finland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

It S Time To Increase Taxes On Capital Gains Finances Of The Nation