what is a tax lot in real estate

Lance Michaels deputy executive director of land use and environmental review at the Department of City Planning said the term tax lot is used to describe a defined tract of. For example if you bought a home 10 years ago for.

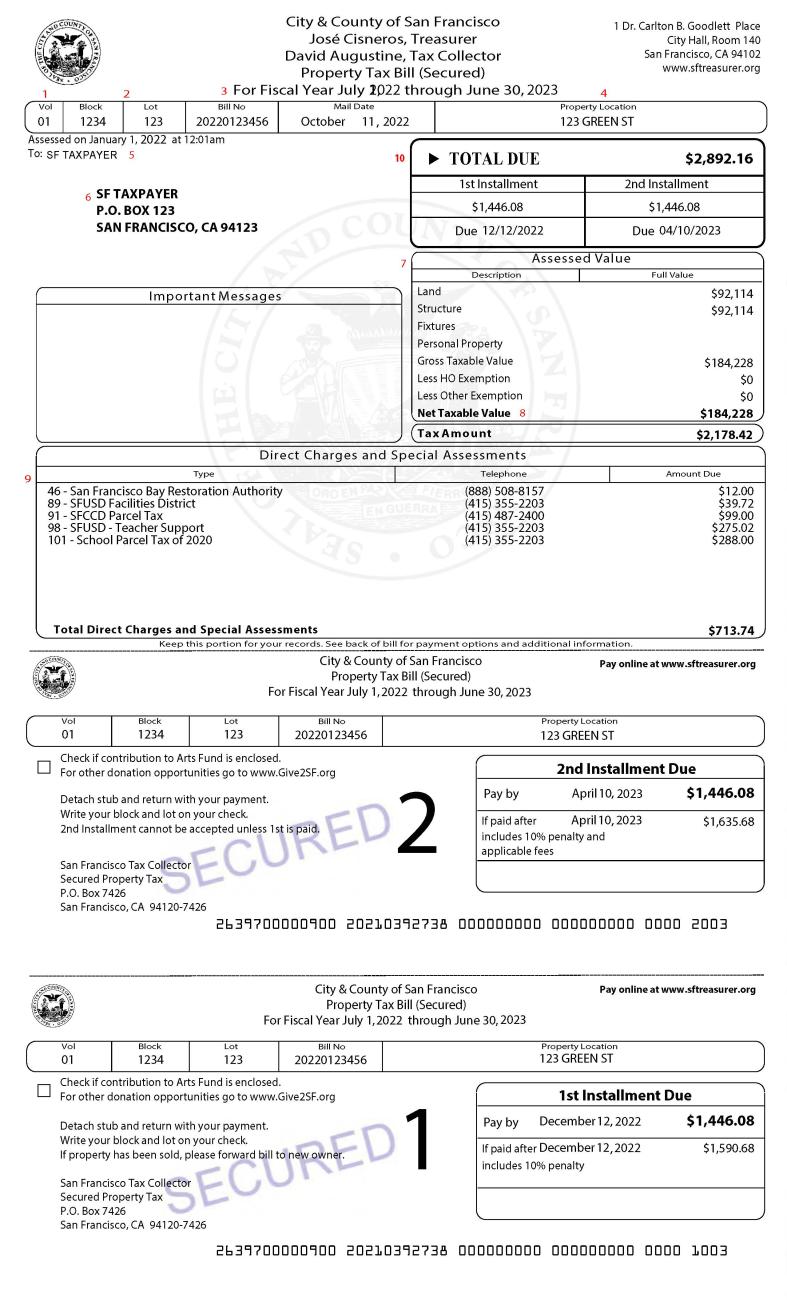

Secured Property Taxes Treasurer Tax Collector

The median property tax in Los Angeles County California is 2989 per year for a home worth the median value of 508800.

. California has a property tax rate of 074 also low compared to the national average. Find All The Assessment Information You Need Here. 617 N PLYMOUTH BLVD 617 LOS ANGELES CA 90004.

Withholding is required on sales or. 250000 of capital gains on real estate if youre single. The first by Dec.

California law states that the tax year runs from July 1 through June 30. Updated on as-needed basis. Listing by REMAX Estate Properties Denise Lavell.

This limit is reduced by the amount by which the cost of. The legal basis is Title II of the Local Government Code LGC Republic Act RA. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

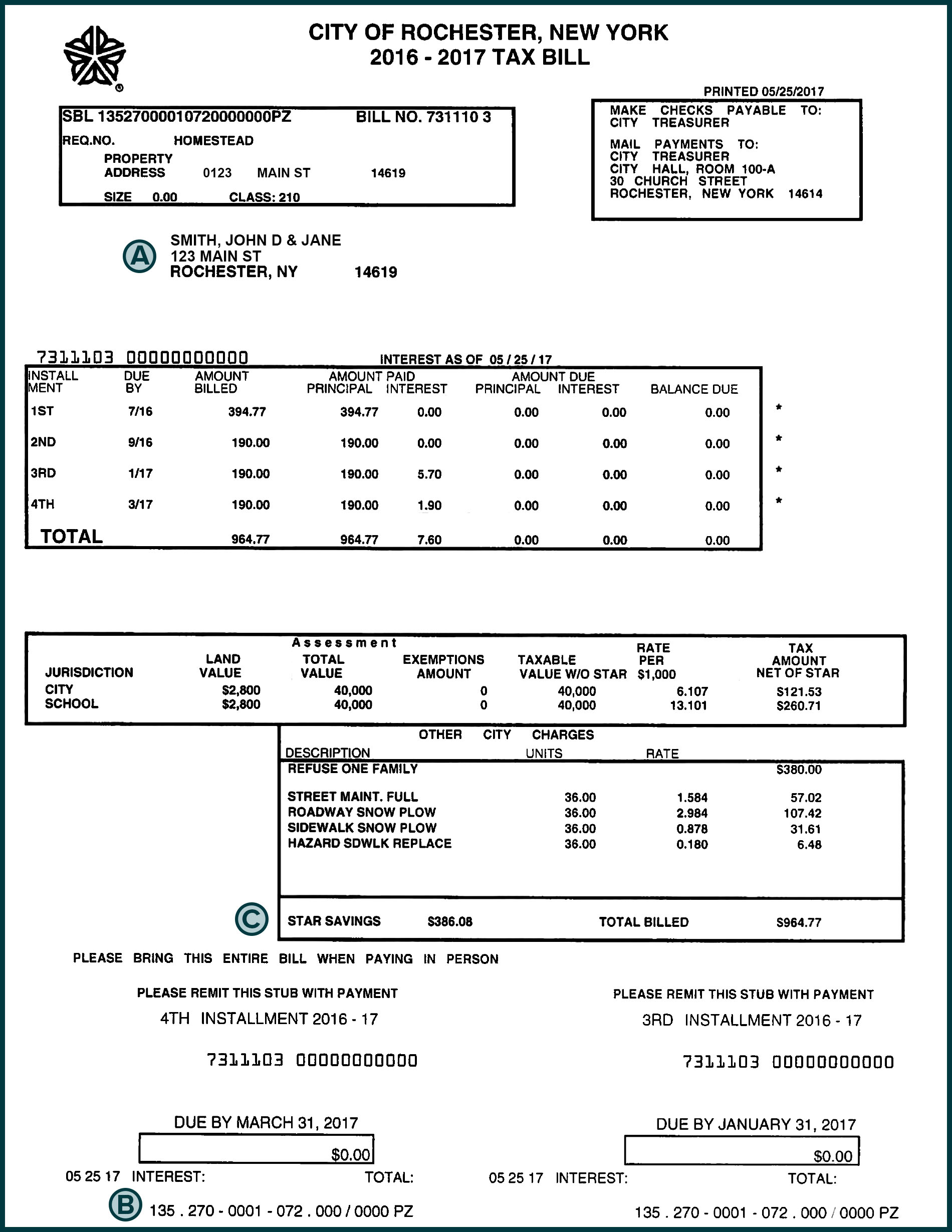

Ad Leading Federal Tax Law Reference Guide. The current 45 transfer tax for all properties would jump to 4 for sales of more than 5 million while transactions that top 10 million. Taxpayers must pay their property tax bill in two installments.

Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning. It gives homeowners a chance to pay those taxes along with high penalty fees. A Complete Guide To The Los Angeles County Transfer Tax.

In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest. A UCLA examination of the proposal found about 4 of real estate sales and transfers in the city would be impacted each year. Fast Reliable Answers.

Discover public property records and information on land house and tax online. The rate of real property tax within the Metropolitan Manila Area is 2 assessed value of the real property. 500000 of capital gains on real estate if youre married and filing jointly.

Nearly three-quarters of the money the. A tax lien sale is a method many states use to force an owner to pay unpaid taxes. Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values.

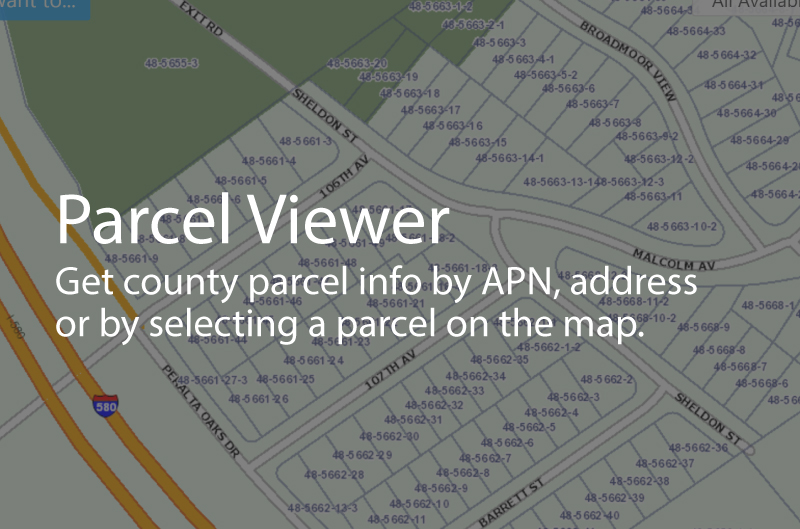

Section 179 deduction dollar limits. Real Property Tax is the tax on real property imposed by the Local Government Unit LGU. Users can see current land uses zoning and general plan designations on properties.

Closing costs and transfer tax confuse a lot of home buyers and sellers as they vary by locationReal estate. A tax lot is a record of all transactions and their tax implications dates of purchase and sale cost basis sale price involving a particular security in a portfolio. For corporations the withholding amount is 884 percent.

Banks and financial corporations are required to pay. How Does Tax Lot Accounting. Real estate withholding is not an additional tax on the sale of real estate but a prepayment of the income tax due on the gain from the sale of real property.

An exclusion is provided for properties that sell for less than 100000. 10 and the second by April 10. Capital gains presumed to be realized from the sale of a real property not categorized as ordinary asset is subject to a tax of six percent 6 based on the highest.

Los Angeles County collects on average 059 of a propertys. Tax lot accounting is a method of record keeping that tracks the cost purchase date and sale date for every unit of every security in a portfolio. Discover the Registered Owner Estimated Land Value Mortgage Information.

Ad View public property records including property assessment mortgage documents and more. Meanwhile property tax on a house in Florida is 9400 given its tax rate of 094 and. The measure is straightforward.

Ad Unsure Of The Value Of Your Property. Map showing current land uses within the City of Redondo Beach. In comparison the rate for provincial areas is 1 of the assessed.

Real Estate Taxes Calculation Methodology And Trends Shenehon

Nyc Real Estate Taxes Blooming Sky

Looking For A Real Estate Bargain It S County Tax Sale Time Hamtramck Review

97122 Or Real Estate Homes For Sale Realtor Com

Understanding California S Property Taxes

How Property Taxes Are Calculated On A New Home Moving Com

1889 Real Estate Tax Bill Receipt San Francisco California Ca Lot Of 7 Ebay

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Malheur County Or Homes For Sale Real Estate Point2 Page 3

What Is A Plat Map It Tells You A Lot About Your Property

Understanding California S Property Taxes

Real Property Tax In The Philippines Important Faqs Lamudi

Commercial Property Records Reonomy